- Find and open the original sales receipt or invoice payment.

- Click Issue Refund button at the top right; or, click More at the bottom of the page, then Refund.

- Click Yes, refund payment. This will appear to be a final step – it is not – you will have the option to make adjustments to the amount/items being refunded in the next step.

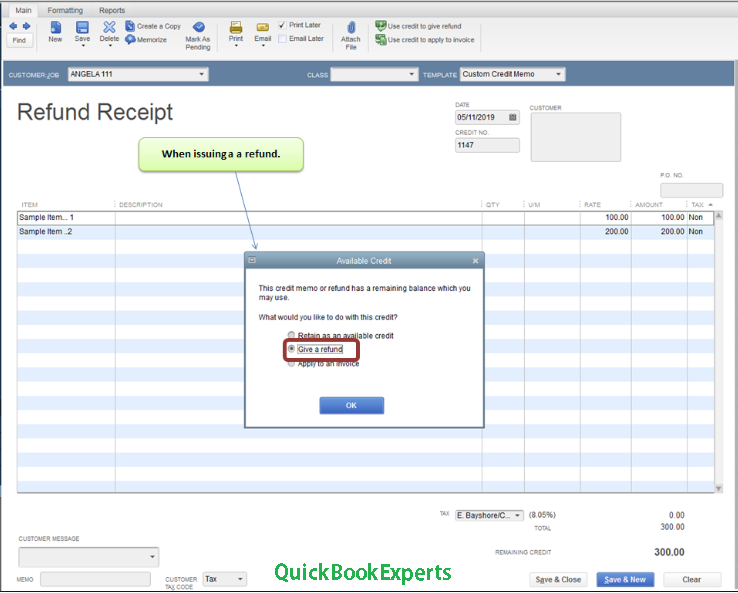

- A new Refund Receipt will open.

- Confirm the refund amount, then click Save and Close to process the refund back to the credit card.

Other credit card refund tasks

Reverse a payment

You should not delete a credit card transaction that has already been processed through your merchant account. To reverse a processed amount, select payment that has been processed, then Void Payment (or Void Refund, as appropriate). If it has already settled, the only way to reverse the amount is to create an offsetting refund receipt (if this is a payment), or an offsetting sales receipt (if this is a refund).

Create a journal entry

There may be instances after correctly completing the refund, where you find there is no balance in Accounts Receivable (AR) for this customer; or in a special situation where the customer opts to use one credit card for a down payment or the entire purchase is paid by Sales Receipt and then the customer requests to use a different credit card or another form of payment for the down payment or purchase at a later date.

In this case, you need to issue a refund receipt and create a journal entry. The refund receipt will place the funds back to the customer’s card and the journal entry places a balance back to AR to account for the refunded down payment:

- Select the Plus icon (+) on the Toolbar.

- Under Other, select Journal Entry.

- On the first line, select Accounts Receivable (A/R).

- Enter the amount refunded in the Debits column and the customers name in the Namecolumn.

- On the second line, select the Income amount used for the item on the Refund Receipt, then enter the transaction amount in the Credits column.

- Select Save.

- Make sure to document the journal entry by referring to the credit card refund. (Required)

Now you’re an expert of How to Cancel Credit Card Processing in QuickBooks, How to void or refund a credit card payment, credit card refund tasks, How to Reverse a payment in QuickBooks, How to Create a Journal entry.

Still Stuck? Or Having a Question?

Call the Customer Care at +1-(818) 900-9884

Or Chat Live to an QuickBooks Expert