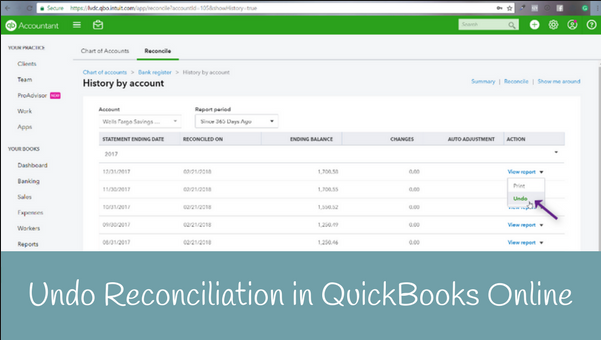

In this Article, We are going to talk about How to unreconcile a transaction or undo a reconciliation in QuickBooks, How to undo reconciliation, QuickBooks, How to unreconcile individual transactions

Manually clear, unclear, reconcile, or unreconcile individual transactions

- Select the Gear icon on the Toolbar.

- Under Your Company, select Chart of Accounts.

- Locate the appropriate account for the transaction.

- From the Action column, select View Register (or Account History).

- Identify the transaction to edit.

- In the reconcile status column (indicated by a check mark), repeatedly select the top line of the transaction to change the status of the transaction.

Codes indicate the status of the transaction:

- C – Cleared

- R – Reconciled

- Blank – Not cleared or reconciled

- Select Save.

Still stuck?

Call: +1-(818) 900 -9884

Email: Info@QuickBookExperts.Com

Chat Live to the Customer Care Executive

More Topics: How to Use employee self-setup for QuickBooks Desktop Payroll