There are lots of QuickBooks Customers have question about Job Costing in QuickBooks Online Today We are Going to learn everything important portion of job Costing in QuickBooks Online. QuickBooks Online now offers a feature called Projects to track your job costs or project profitability. See QuickBooks Online Projects for more details.

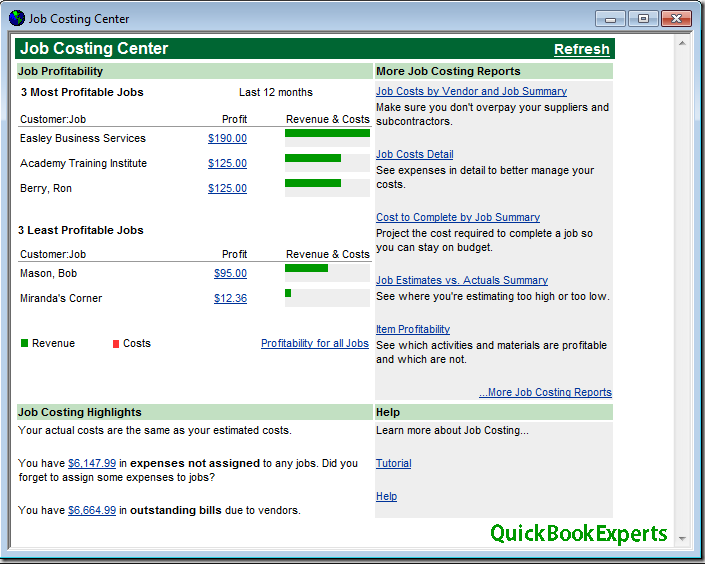

Job costing is accounting which tracks the costs and revenues by “job” and enables standardized reporting of profitability by job.

Job costing is a business accounting term that means the tracking of costs and revenues by “job” and the standardized reporting of profitability by job. It is a tool for tracking the specific costs of labour, materials, and overhead related to individual jobs and using that information to see if costs can be reduced in future jobs.

Given its importance, it’s good to know how to perform job costing in QuickBooks Online (QBO). QuickBooks Online allows you to do job costing for 1099 contractor costs and other expenses. Note, there’s still no integrated payroll option that does labor costing. Let’s go step-by-step to see how you can perform job costing in Quickbooks Online.

Everything you need to know about Job Costing in QuickBooks.

Before you can start tracking costs, you’ll need a QuickBooks Online Plus subscription, because Budgets are not available in the Simple Start or Essentials levels. When you’re ready to begin job costing, the first thing you need to do is track expenses by customer.

Step 1: Track Expenses by Customer

To track expenses by customer, you’ll first need to adjust your expense tracking preferences in the Company Settings. Click the “Company Name” and/or Gear Icon in the top right hand corner of your QuickBooks Online Screen, then click “Company Settings.”

Step 2: Update Setting On Your Customer List

The next step is to adjust the settings on your customer list. We’ll be using sub-customers (these are called Jobs in the desktop editions of QuickBooks), and choosing the “Bill with Parent” option in the customer preferences

Step 3: Adjust Settings on Products & Services

To use Products and Services (what is called the Item List in QuickBooks Desktop editions) for job costing, you’ll need to tell QBO that you purchase each one from a vendor.

Not everything on this list needs to be set up this way. To access this list, you’ll want to click the “Company Name”/Gear Icon, then choose “Products and Services” from the List menu.

Job Costing in QuickBooks: Putting It All Together

Job costing in QuickBooks is a fairly involved process. However, as the old adage goes, practice makes perfect. Continue your Quickbooks training and once you get the hang of it, job costing in QuickBooks will come naturally.

One more resource we want to share is the video that shows this that the QBShow.com co-host, Woody Adams, created. Happy job costing in QuickBooks Online!

Still Having a Question about Job Costing?

Call : Email : Chat Live

More Topics: Get paid faster with QuickBooks invoicing

FAQ: QuickBooks Online price increase for July 2019 in United States