In 2020, there are lots of errors facing by QuickBooks Software, But we Every Error has its solution. Lets learn that solution How to reimburse an employee in QuickBooks and Record Employee Reimbursement in QuickBooks Online. So Error in QuickBooks bothers you?

There are two ways to do this Follow these steps to pay the employee now:

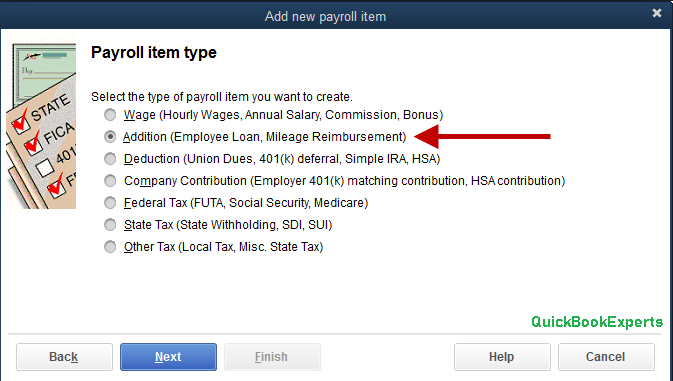

- If you use QuickBooks payroll, you can create a payroll item that is a reimbursement. This will allow you to reimburse them on their paycheck. To do this go to the employee list in payroll. Choose the employee you wish to give a reimbursement to. Edit the employee, and go to payment types. Check the box for reimbursement. This will create a new field for reimbursement when you process payroll. Enter the reimbursement amount in that field and note in the memo what it is for.

- You can create a check, made payable to the employee. The distribution on the check would be the account(s) that cover whatever you are reimbursing for (I.e. office expense, auto expense, travel, etc) make sure to notate that it is for reimbursement in the memo for doing Record Employee Reimbursement in QuickBooks Online.

Or

- Select the Plus sign (+) icon on the Toolbar, then select Cheque or Expense to record a payment to the employee, with attention to these fields:

- Choose a PayeeB The employee.

- Bank account or Cash account: Select which account you reimburse the employee from (bank or petty cash).

- Amount: Enter the amount owed to your employee. (Break down the amount into different line items if tracking or making billable for multiple customers.)

- Account: Choose from the drop-down menu the expense account appropriate for the purchase the employee made. (Note: If you don’t have one yet, type a name such as “Employee reimbursement” and press Enter.)

- Billable: (Optional) Select the box under the Billable column if you wish to offset the expense onto your customers invoice.

- Customer: (Optional) Select a customer from the drop-down menu if you are looking to track the expense for a specific customer or customers. (Note: The customer and billable fields are not available in QBO Simple Start, but in QuickBooks Online Plus you may turn on the feature. To do so, see How do I turn on Billable Expenses?)

- Select Save and Print.

You can record the expense as a journal entry, and then pay the employee later after the end of the month or to coincide with the end of a pay period: (reimburse an employee in QuickBooks)

- Select the Plus icon (+) on the Toolbar.

- Under Other select Journal Entry to enter a transaction showing you owe the employee money.

- On the first distribution line, select the account used for tracking Employee reimbursement. If you don’t have one yet:

- Select +Add new.

- Name the account “Employee reimbursement.”

- From the Account Type drop-down, choose Other Current Liabilities.

- From the Detail Type drop-down, choose Other Current Liabilities.

- Select Save and close.

- On the second distribution line, enter:

- Account: The expense account appropriate for the purchase the employee made.

- Debits: Amount of purchase.

- Name: If you want the expense associated with a customer, choose a customer. Otherwise, leave Name empty.

- Select Save.

Need more help? Reach Us

Call +1-(818) 900-9884

Live Chat to an Experts

More Options: Hierarchical View in Quickbooks