Quick Tip: The total sales and total income will not always match because there are transactions that can appear in a data file that will make it unlikely for the Sales Tax Liability and Profit and Loss reports to match. You can compare the two reports to see which transactions are causing the discrepancies.

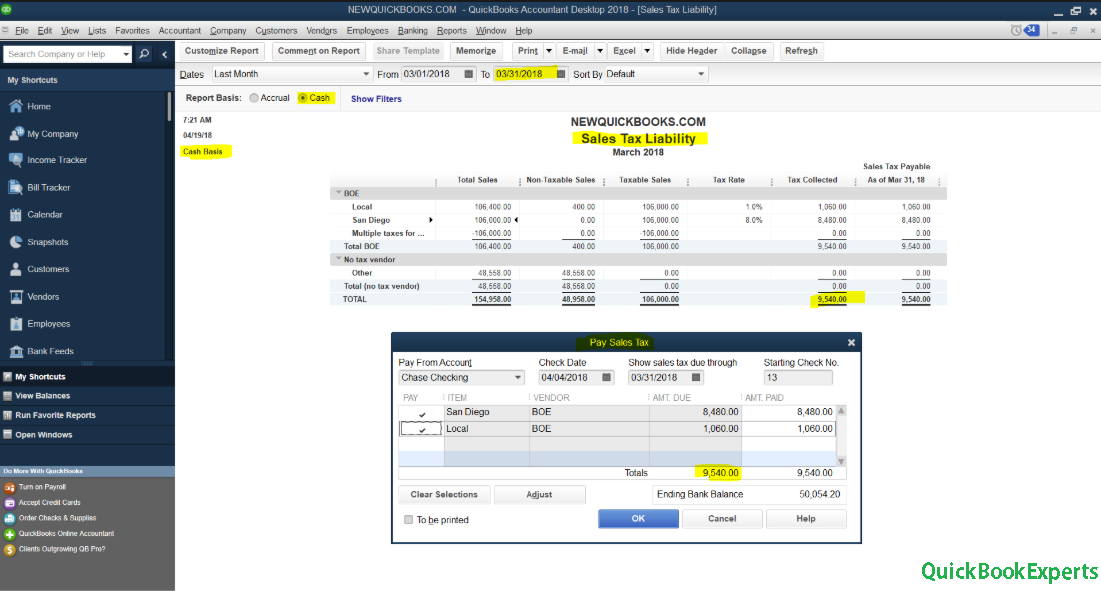

Sales Tax Liability

- From the Reports menu, select Vendors & Payables > Sales Tax Liability.

- Double-click the Total for Total Sales column. This will open the Sales Tax Revenue QuickZoom report.

- Select Customize Report.

- Choose the correct report basis, Accrual or Cash.

- Under the Display tab, select the date range for the report.

- Under the Filters tab, choose Accounts.

- From the drop-down menu, select All ordinary income accounts.

- Still under the Filters tab, select Transaction Type and choose Multiple Transaction Types from the drop-down menu.

- In the box that opens, put a check mark next to all transaction types excluding Invoice and Sale Receipt.

- Select OK to return to the Filters window.

- Select OK again to return to the report.

Profit and Loss Standard

- From the Reports menu, select Company & Financial > Profit & Loss Standard.

- Double-click Total Income.

- Select Customize Report.

- Choose the correct report basis, Accrual or Cash.

- On the Display tab, select the same date range.

- Under the Filters tab, choose Accounts.

- From the drop-down menu, select All ordinary income accounts.

- Still under the Filters tab, select Transaction Type and choose Multiple Transaction Types from the drop-down menu.

- In the box that opens, put a check mark next to all transaction types excluding Invoice and Sale Receipt.

- Select OK to return to the Filters window.

- Select OK again to return to the report.