I had a problem with my undeposited funds window which the accountant this year (2018) determined that there was a problem in 2015 Undeposited Funds in Quickbooks Desktop in 2020. I was told to make a general journal entry from undeposited funds into the misc. income account. I did that and had it show up in the "Make deposits" window, I was told to $0 out the deposit by entering a negative amount. I have done this but now I am back to the original balance in my undeposited funds account. I have tried reversing it, delete, enter again etc., and I can get the Chart of Accounts to zero out by then it won't go away in the deposits window. The undeposited funds is a negative (-337.11) and the general journal entry won't let me add in a negative to both accounts.

Thank you for the additional details about how the deposits were recorded. I’m here to help clear the negative balance in the Undeposited Funds account.

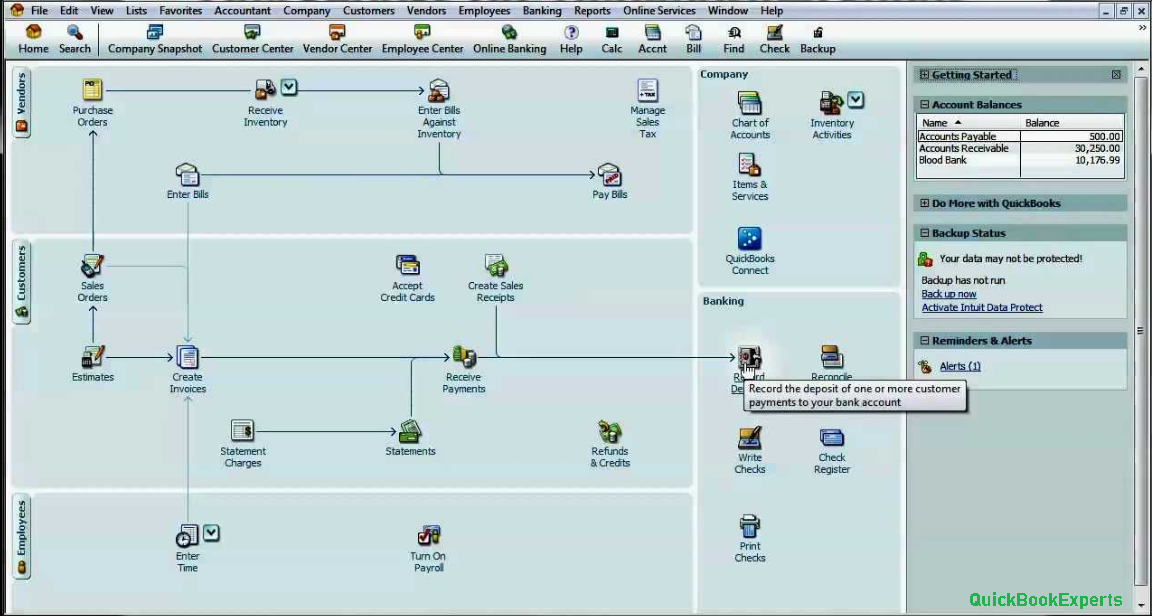

QuickBooks Desktop automatically holds the funds in the Undeposited Funds account when receiving payments from customers. In order to clear the amount in this account, you’ll need to make deposits.

Since the deposits were recorded as journal entries (JE) crediting the clearing account, you’ll need delete them including the one going to the Misc. Income account. Then, deposit the payment to your desired bank.

I recommend backing up your company file before making any changes since the process can’t be reversed.

To delete the journal entries:

1. Go to the Lists menu.

2. Select Chart of Accounts.

3. Double-click Undeposited Funds.

4. Double-click the JE to open it, one at a time.

5. Press Ctrl + D on the keyboard to delete.

Now let’s deposit the payments. Here’s how:

1. Go to the Banking menu.

2. Select Make Deposits.

3. Select the payment in the Payments to Deposit window.

4. Select the bank where you want to deposit the funds.

5. Click Save and Close.

If you need to move the amount to the Misc. Income account, you can create a JE. I still suggest consulting your accountant on which accounts to debit and credit.

You can go through Understand how the undeposited funds account works for additional information. Undeposited Funds in Quickbooks Desktop in 2020

If there’s anything else you need, you can contact us directly.

Chat Live to the Customer Care Executive.