How to Pay outside the Pay Period in QuickBooks Online Payroll

In this Article We are going to discuss about How to Pay outside the Pay Period in QuickBooks Online Payroll, In other words we are going to answer all questions about Pay period in Quickbooks payroll

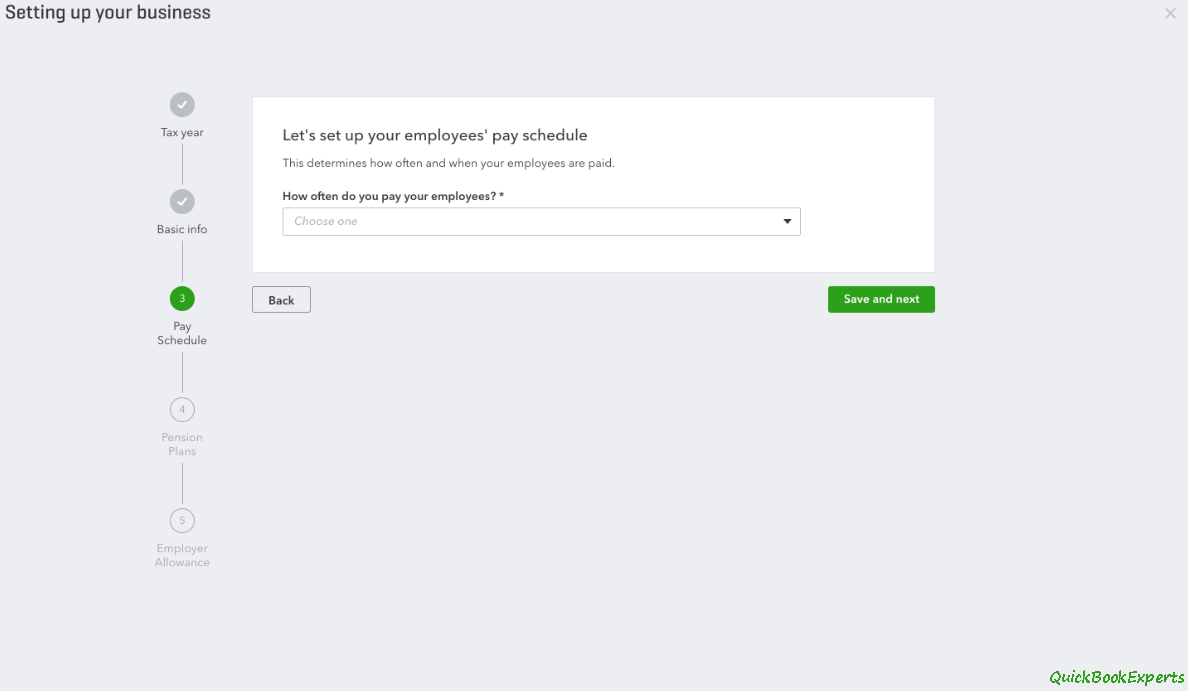

Before your pay your employees in QuickBooks Online you must specify your pay schedule.

You can create your pay schedule in two places:

- First Time Use

- Payroll Settings

First Time Use

You Can See:

-

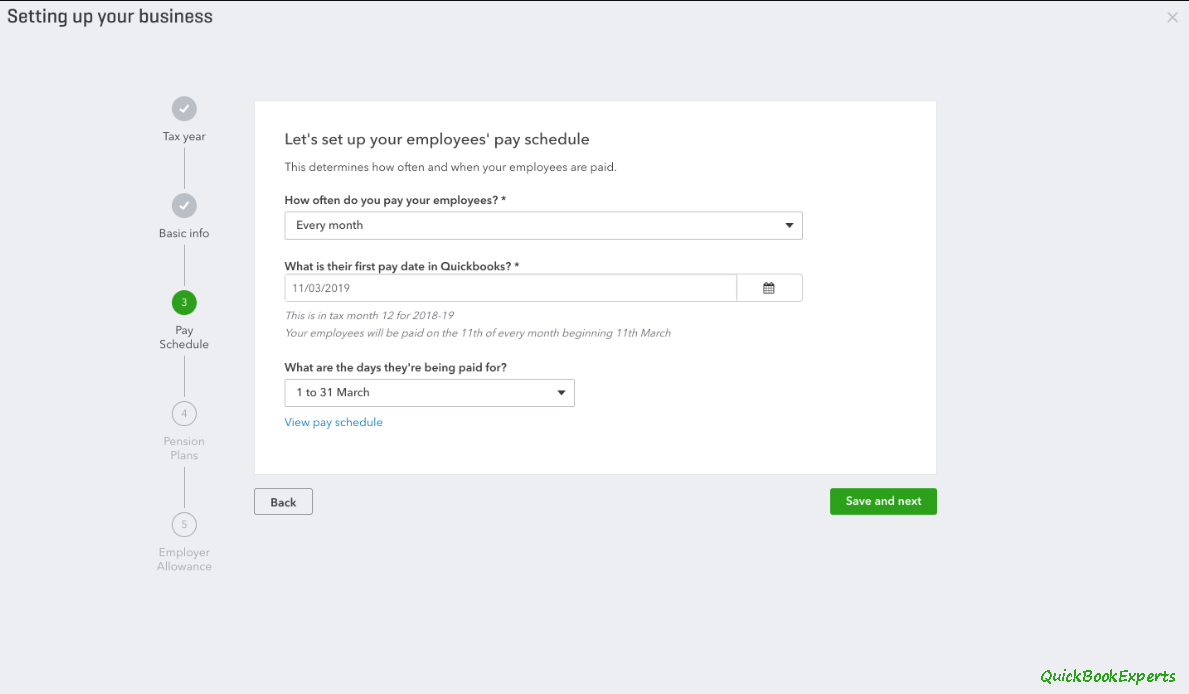

How Frequently do you pay your employees?

-

What’s their first pay date in QuickBooks?

-

For what those days paid for

If you are selecting Something Else, you are telling QuickBooks Online Standard Payroll that your employees are paid outside their pay date.

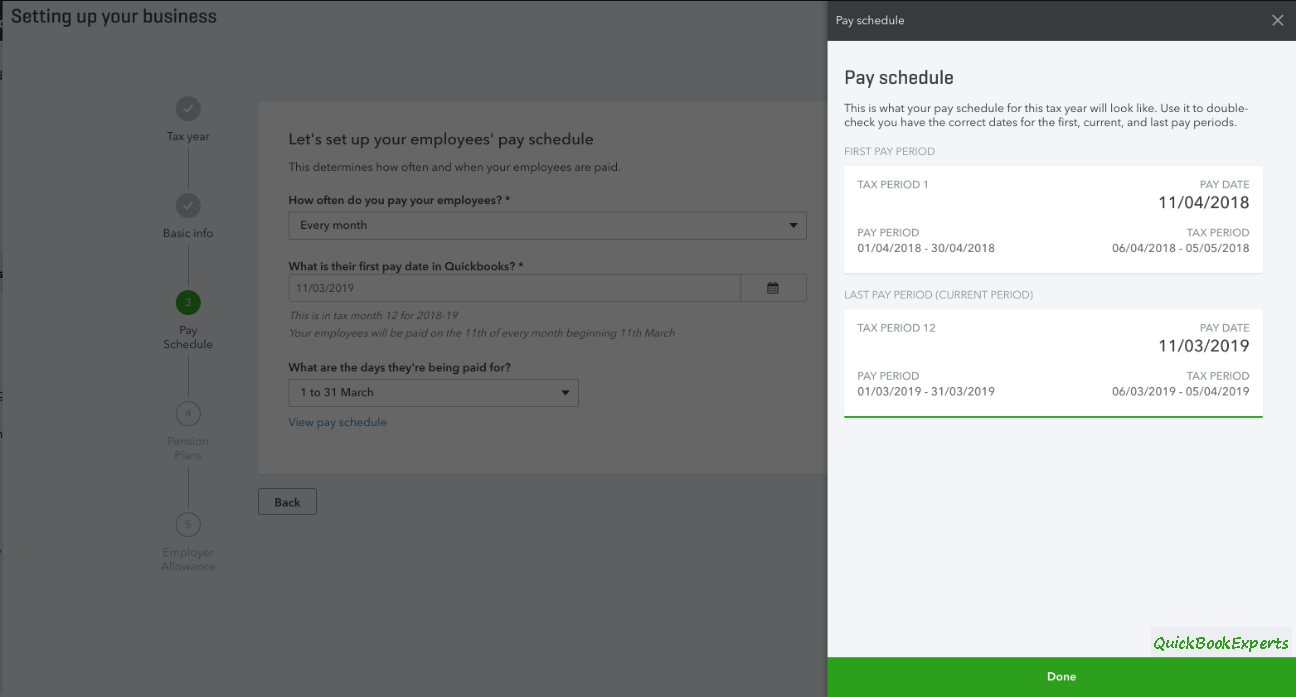

Once you have entered all the applicable information, the pay schedule card will appear from the left hand side of the menu and exhibit you your first pay period along the pay date, the modern pay period and pay date and what your last pay duration will be.

Payroll Settings

If you need to make any changes once you have saved these details, you can edit within the Gear icon > Account & Settings > Payroll.

Please note: When your payroll is submitted you cannot make any modifications to the

pay schedule, you will need to delete the pay run and begin again.

and now you know How to Pay outside the Pay Period in QuickBooks Online Payroll.