Inventory valuation amounts in Point of Sale and QuickBooks Desktop do not match in 2019

Why ? Inventory valuation amounts in Point of Sale and QuickBooks Desktop do not match in 2019

Find out why the amounts in your Inventory Valuation amounts in Point of Sale and QuickBooks Desktop are not the same.

An Inventory Valuation report consists of the monetary cost of your items that make your inventory, summarized data of quantity, average cost, and extended value.

The data on the report should ideally reflect the figures of Inventory Asset in the Balance Sheet, given the following conditions:

- You started using QuickBooks Desktop and POS company files at the same time

- No transactions affecting inventory were entered in QuickBooks Desktop

What happens after importing your items from QuickBooks Desktop to Point of Sale?

Items in QuickBooks doesn’t automatically transfer to Point of Sale unless you import the items.

Since the items were imported in Point of Sale, the Inventory Valuation Report in QuickBooks Desktop will be zeroed out because of the quantity adjustment that occurred during import.

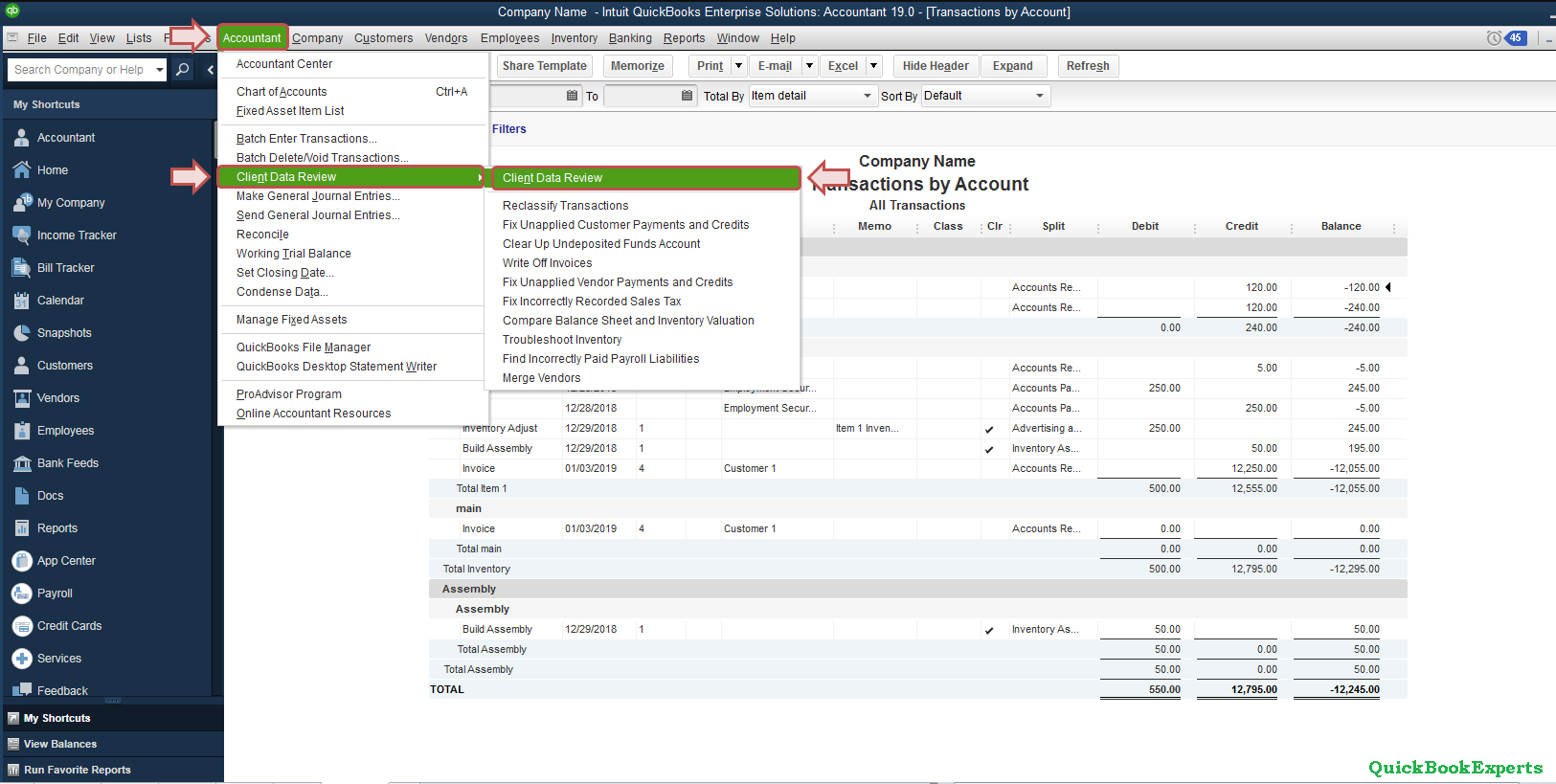

Compare the reports

- Open the Inventory Valuation report in Point of Sale.

- From the Reports menu, select Items then Inventory Valuation.

- Select Today for the date.

- Select Apply date.

- Open Balance Sheet Report in QuickBooks Desktop.

- From the Reports menu, select Company & Financial, then choose Balance Sheet Detail.

- Select the date to All, and set the report to Accrual.

- Scroll down to Inventory Asset, then on the Balance column, compare the reports line by line to find the discrepancy.

Having a Question ? Reach Us

Call : Email : Live Chat to an Experts

More Options : QuickBooks 2016 and Mac Mojave 2019