What is Single Touch Payroll? How It Works? How to Enable STP?

Single Touch Payroll (also known as STP) is a government initiative to streamline your business reporting obligations regarding payroll in QuickBooks.

Explore all there is to know about STP and the changes to payroll reporting.

Single Touch Payroll (STP) is a new way of reporting tax and super information to the ATO.

Put simply, STP requires employers (or their registered agent) to report payments such salaries, wages, PAYG withholding, and superannuation information directly to the ATO from their payroll system. This must be reported after every pay run has been finalized by no later that the employee’s payment date.

Single Touch Payroll benefits

Becoming STP ready is more than just adopting new accounting software. With QuickBooks, you can be confident that your books are accurate, your staff are paid, and your business is ATO compliant.

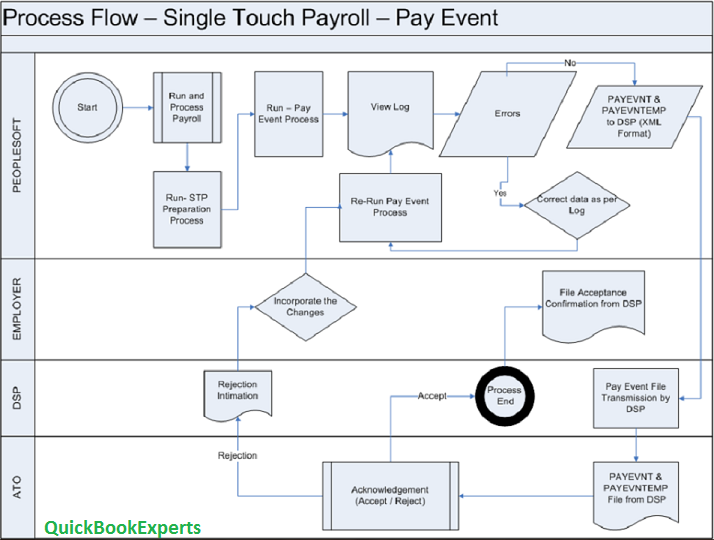

How STP works ?

Whatever your business, if you pay staff, you’ll need to know about STP. We’ve been working closely with the ATO to make sure you know exactly what to do and when to do it.

Starting July 1, 2019, all employers must be STP compliant.

Setting up ATO Supplier Settings

- Select Employees in the left hand menu

- Click the Payroll Settings tab

- Select ATO Settings

From here the steps differ slightly if you are setting up as the employer, as a registered Tax/BAS Agent or as an intermediary for multiple employing entities.

Note: STP is already compulsory for employers with 20 or more employees.