In this Article we are going to talk about How do I Correct the Mapping of the Sales Tax item to the Correct Account in the Chart of Accounts, Correct mapping of the Sales tax item to the Correct amount in Charts of Accounts.

First, decide which between the two accounts would you set up as the parent account. Once done, you can proceed with merging the sub-accounts.

Here’s how:

- Go to the Gear icon.

- Select Chart of Accounts.

- In the Chart of Accounts window, look for the second Sales Tax Payable account.

- Click the Action drop-down arrow, choose Edit.

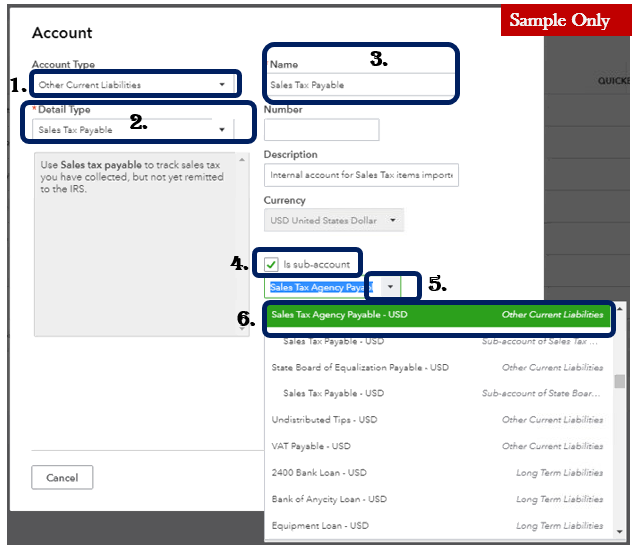

- Review the details of the account

- Make sure to put a check mark on Is a sub-account.

- Click the drop-down arrow,

- Choose Account and Detail Type.

- Choose the parent which you’ve created first.

- Hit Save and Close.

That should do it! Once completed, you need not to worry about the Sales tax payments recorded on each accounts since it will be merged. Thus, there’s no need to manually re-mapped it. To know more about How to Correct the Mapping in the Chart of Accounts? (Contact us)

Fill us in if you have other questions about recording your Sales Tax payments in one account in your Chart of Accounts. we’re always here to help.