PPP Loan Account Setup | How do I enter the PPP Loan into my Deposit?

Learn how to enter the PPP loan in to deposits, You can use the QuickBooks Desktop Loan Manager to help you track the PPP loan. Before you set up the accounts for the loan manager, you’ll want to make sure you have a liability, vendor, and expense account set up for the loan. Then, you can set up an escrow account for the portion of the loan that’s managed by a third-party. Here’s how:

- Go to the Lists menu and select Chart of Accounts

- Hit the Account drop-down, then push New.

- Choose Other Account Types, and then Other Current Assets.

- Press Continue and enter the account name.

- Click Save and Close

Next, you’ll want to record and track your loans by following these steps:

- Navigate to the Banking menu and select Loan Manager.

- Press Add a Loan.

- Enter the account info for the loan (Account Name, Lender, Origination Date, Original Amount, and Term), then when you’re ready, hit Next.

- Insert the loan’s payment info (Due Date of Next Payment, Payment Amount, and Next Payment Number) and push Next.

- Enter the interest info (Interest Rate, Compounding Period, Payment Amount, Interest Expense Account, and Fees/Charges Expense Account) and choose Finish when you’re done.

Now you can track your loan in QuickBooks. You may find this article helpful as well: QuickBooks Loan Manager.

Recording Loan Payments

- Click “Banking” in the main menu and then select “Write Checks” in the context menu.

- Enter the payee name and repayment amount in the applicable fields in the Write Checks window.

- Assign the interest element of the loan repayment to your preferred expense account in the detail area of the Write Checks window. Assign the rest of the payment, also known as the principal, to the liability account you created to track the loan.

- Click the “Edit” button and then select the “Memorize Check” option if you want QuickBooks to enter this payment automatically at regular intervals and issue a payment reminder.

- Click the “Save and Close” button to save the transaction and exit the window.

How do I enter the PPP loan into my deposit?

More guidance/clarification is needed on this issue. For now, the deposit goes to the PPP Loan Short term account in QBO.

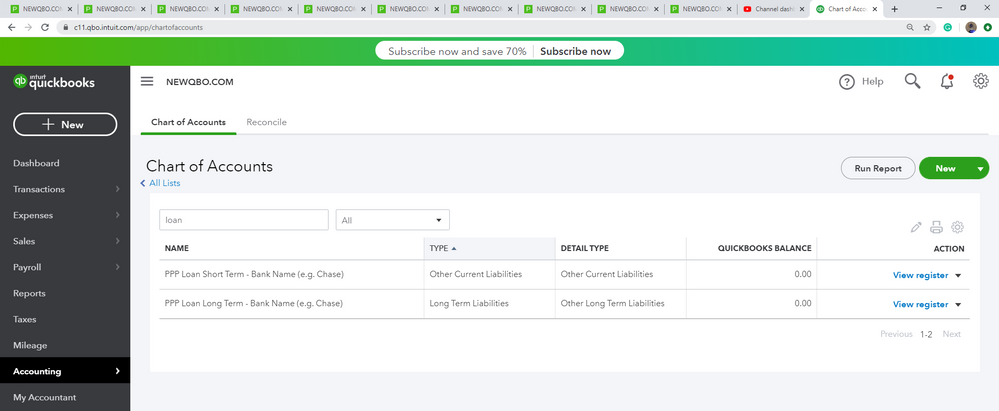

I would create two new accounts for PPP Loan Account Setup:

1) PPP Loan Short Term – Bank Name (e.g. Chase)

2) PPP Loan Long Term – Bank Name (e.g. Chase)

See the screenshot below for reference.

#1 could turn into a grant loan (Forgiveness of loan)

#2 remaining balance would be a 2-year loan for PPP Loan Account Setup

Again, more guidance is needed in this area later. Feel free to post below if you have any other questions. I’m always here to lend a helping hand.